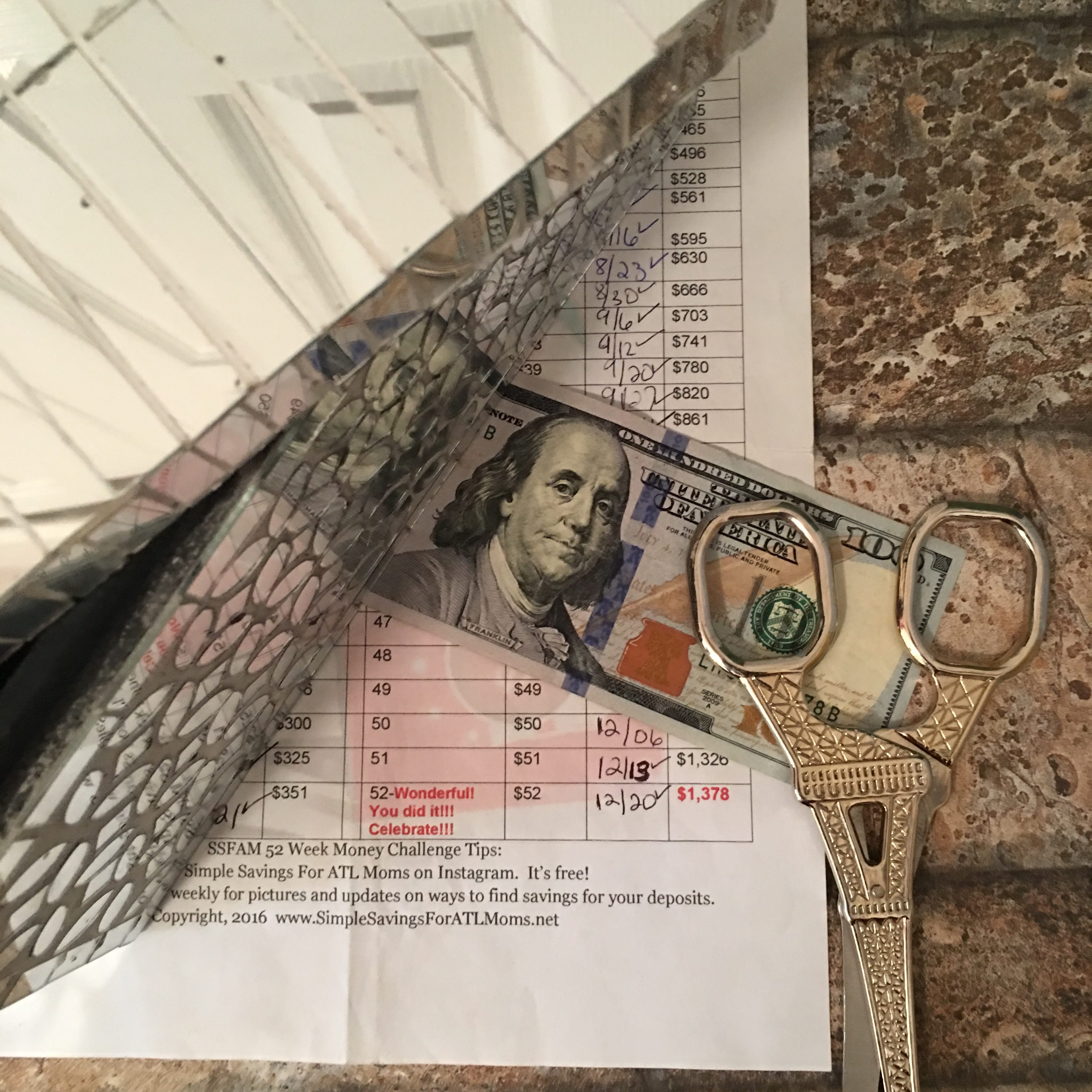

Welcome to the #SSFAM 52 Week Money Saving Challenge! It’s the Final Week 52 of the 2016 challenge. Pull out your coins or just get $52 to deposit or put it in a safe Saving place (Savings Account, Money Saving Jar, etc.)! We have made it to $1,378.

Starting 1.3.17 you will see me share my savings and deposits on every Tuesday. Feel free to join me so that you can get some extra savings in your pockets. Follow my Instagram for immediate picture deals my weekly Instagram Saving photos! Go here now to download your FREE 2017 Money Saving Chart.

I was suggested this website by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my trouble. You are wonderful! Thanks!Nice blog here! Also your web site loads up fast! What web host are you using? Can I get your affiliate link to your host? I wish my website loaded up as quickly as yours lol

Thank you, I have recently been searching for information about this topic for ages and yours is the best I have discovered so far.

All through the year I’ve been waiting for the starting on the new year for this. I do have a question though. I see each week the amount you deposit gets higher so what can those who get paid every 2wks do? Putting in $100+ each pay day would be impossible for me. I only work part time so i don’t make much at all.

Hey Ada, thanks for the question. The main purpose of this challenge is for you to just “get started” in a mindset at Saving Money and Identify what you are Saving Money for. If you only get paid every 2 weeks, first determine what are you saving the money towards (car, new home deposit, clothes, education costs, books, etc.).

Then divide up how much you would need to save each month or per pay period for the year to accomplish “your” goal at the end of 2017 that you can comfortably afford to do. You can create a Savings plan that will work best for you especially if you can’t save the amount each week listed on the worksheet. There are some who save backwards so they have less to deposit at the end of the year.

Another option you may consider is saving only a specific amount each month for 12 months. You can consider scheduling with your bank to withdraw it from your account to go directly to your savings account each month. For example, January have them withdraw $10, February $26, March $42, April $58, May $74, June $90, July $106, August $122, September $138, October $154, November $170, December split up 2 payments $186 and then $202. You will have saved $1,378.00 for 2017.

3rd option Save $1,000 for 2017 by just saving $10 each week for 52 weeks.

I hope any one of these are helpful for you. I will be creating worksheets for all of these just in case you choose any other besides my current one.

Thanks for joining in. 🙂